Learn how to manage payouts that get returned.

There are several reasons why payouts (also known as Funding Transfers) can fail and return to you. The most common reason is that the Seller's payout bank account information is incorrect.

When Funding Transfers fail, Finix will mark them as failed and tagged with the ACH Return Reason Code. You may need to reach out to your seller to update bank account information.

If a payout to a merchant's bank account does not go through, you can resend the failed funding transfer using the Finix dashboard after the Merchant has updated their bank account information.

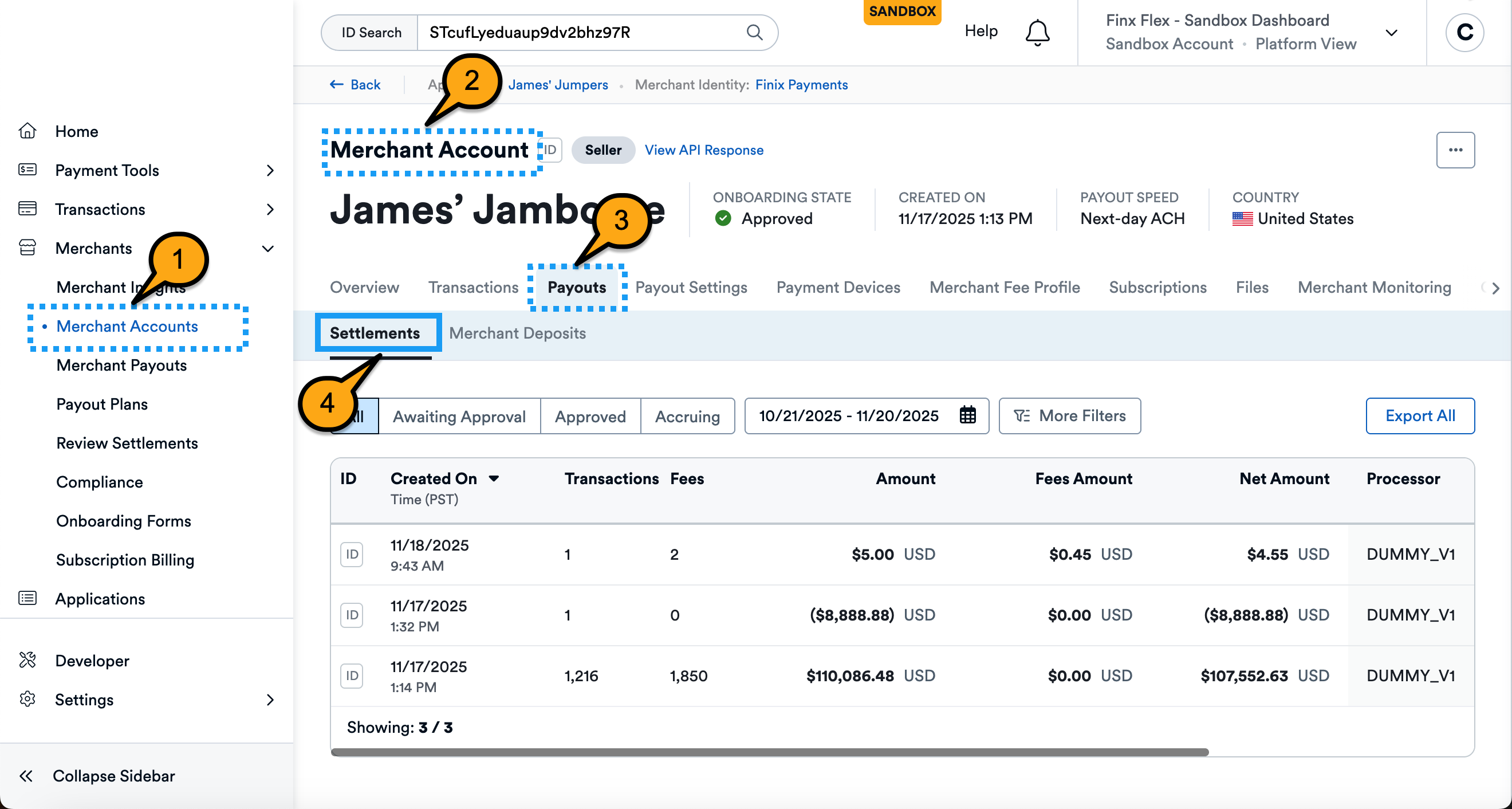

To resend a failed funding transfer using the dashboard:

From the Merchant Account page, click Payouts, then Settlements.

Click a settlement from the list of settlements to view its details.

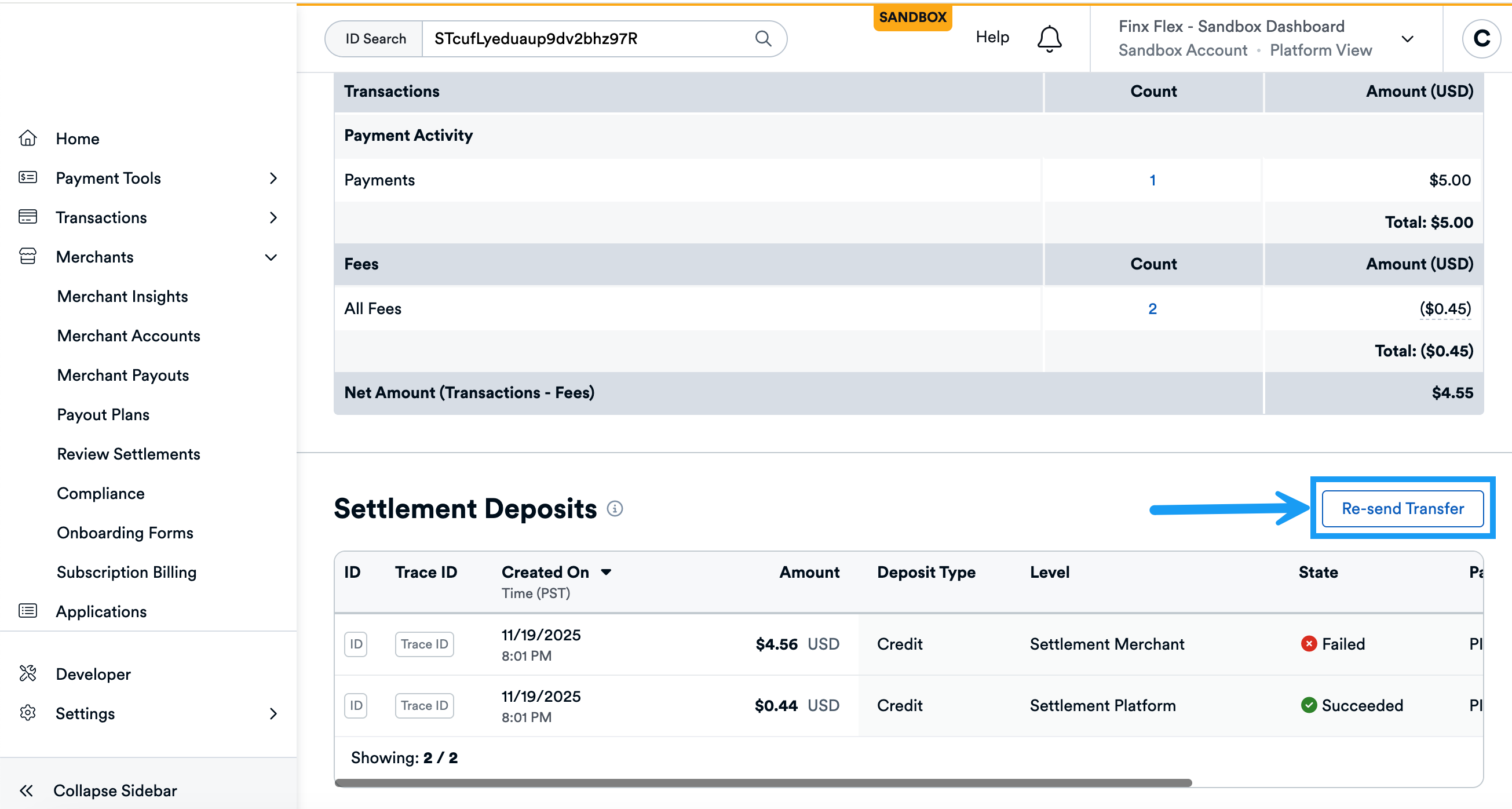

Scroll down to Settlement Deposits to see a list of all settlement funding transfers.

A failed settlement funding transfer is in a

Failedstate.You can resend the transfer by clicking the Re-send Transfer button.

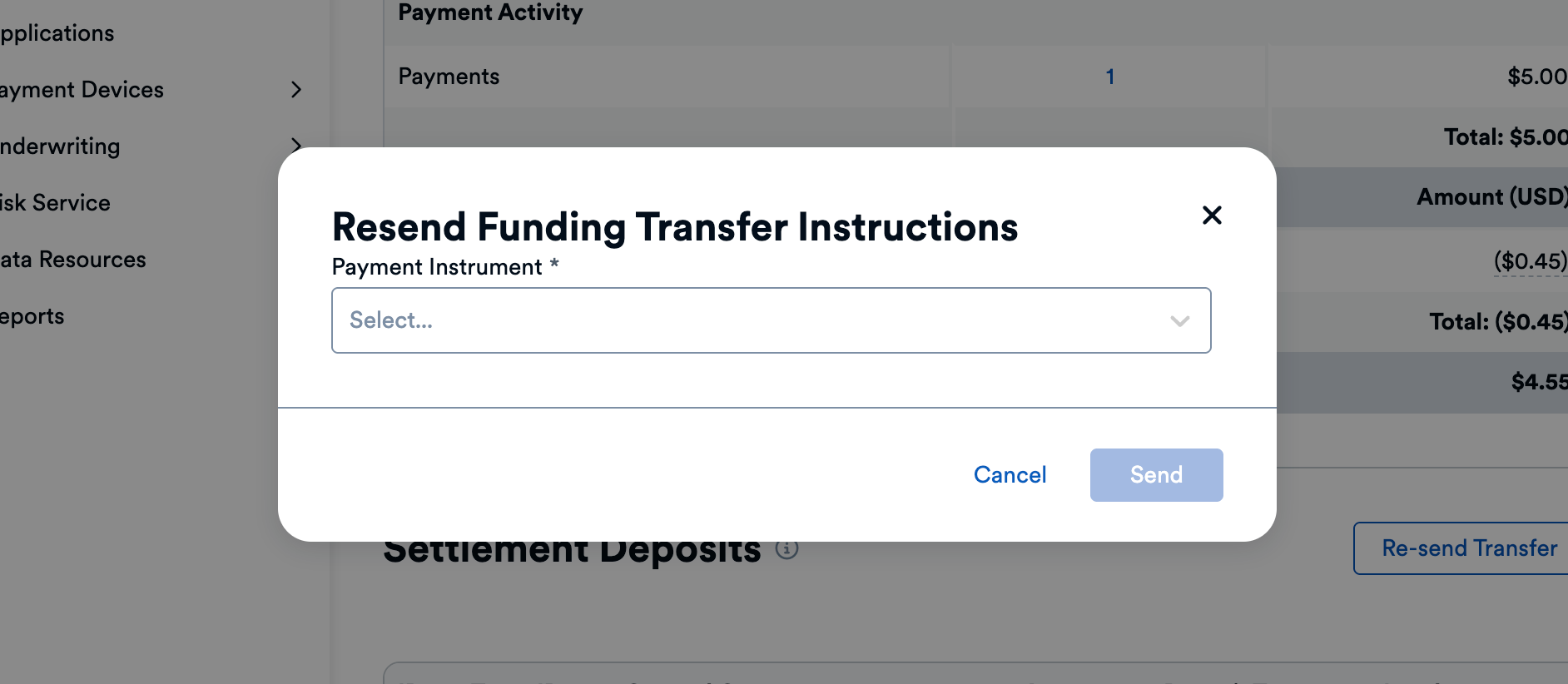

- A Resend Funding Transfer Instructions modal displays.

From the modal, select a Payment Instrument.

- If successful, a new settlement funding transfer displays in the list with a state of

SUCCEEDED.

- If successful, a new settlement funding transfer displays in the list with a state of

To resend a failed settlement funding transfer, send a request to the PUT /settlements/{settlement_id}, including the destination (merchant's bank account) and rail (always ACH) in the request body:

curl -i -X PUT \

-u USrsBRw5q8f8ZcuWvrWsZro1:c00462f6-251c-47a7-aa12-31d7e7b4fa8c \

https://finix.sandbox-payments-api.com/settlements/STcuLDR3uAhut6DBAnDSB2a \

-H 'Content-Type: application/json' \

-H 'Finix-Version: 2022-02-01' \

-d '{

"destination": "PIeuV9AEb5hFxSzVLDqiGdne",

"rail": "ACH"

}'To confirm if the retry was successful, list the settlement funding transfers and look for a new Transfer marked as CREDIT with the same details and amount as the failed transfer.

You can fetch Funding Transfers from the /transfers endpoint. Funding Transfers get processed on the ACH rails and behave similarly to ACH payments (also known as eChecks).

{

"id": "TRxxxxxx",

"amount": 500,

"tags": {},

"state": "FAILED",

"trace_id": "FNXxxxxxx",

"currency": "USD",

"application": "APxxxxxx",

"source": null,

"destination": "PIxxxxx",

"ready_to_settle_at": null,

"fee": 0,

"statement_descriptor": null,

"type": "CREDIT",

"messages": [

"ReasonCode: R03",

"ReasonDescription: No Account/Unable to Locate Account",

"Declined because there is a record in FAILED_FUNDS for 'FNXxxxxxxx' transfer"

],

"raw": {

"Return Date": "xx/xx/2019",

"Original Date": "xx/xx/2019",

"Attempted Funds Transfer Date": "xx/xx/2019",

"Merchant Name": "xxx xxxx xxxx xxx",

"Sub Merchant Business Name": "xxx xxx xxx",

"Funding Sub Merchant ID": "0xxxxxx",

"Funds Transfer Request ID": "FNXxxxxx",

"Vantiv Payment ID": "xxxxx",

"Txn Type": "FISC",

"Funds Transfer Amount": 500.0,

"Reason Code": "R03",

"Reason Message": "No Account/Unable to Locate Account",

"Routing Number": "xxxxx",

"Account Number": "XXxxxxx",

"Account Name": "xxx xxx xxx"

},

"created_at": "xxxx",

"updated_at": "xxxx",

"idempotency_id": null,

"merchant": "MUxxxxx",

"merchant_identity": "IDxxxxx",

"subtype": "SETTLEMENT_MERCHANT",

"_links": {

"application": {

"href": "https://finix.sandbox-payments-api.com/applications/APxxxxxx"

},

"self": {

"href": "https://finix.sandbox-payments-api.com/transfers/TRxxxxxx"

},

"merchant_identity": {

"href": "https://finix.sandbox-payments-api.com/identities/IDxxxxx"

},

"payment_instruments": {

"href": "https://finix.sandbox-payments-api.com/transfers/TRxxxxxx/payment_instruments"

},

"reversals": {

"href": "https://finix.sandbox-payments-api.com/transfers/TRxxxxxx/reversals"

},

"fees": {

"href": "https://finix.sandbox-payments-api.com/transfers/TRxxxxxx/fees"

},

"disputes": {

"href": "https://finix.sandbox-payments-api.com/transfers/TRxxxxxx/disputes"

},

"source": {

"href": "https://finix.sandbox-payments-api.com/payment_instruments/PIxxxxx"

},

"fee_profile": {

"href": "https://finix.sandbox-payments-api.com/fee_profiles/FPvCQUcnsueN3Bc3zR1qCBG8"

}

}

}Failed funding transfers will receive these ACH Return Reason Codes in the Transfer's messages array.

| Code | Failure Message | Description | Next Steps |

|---|---|---|---|

| R01 | Insufficient Funds | The bank account doesn't have enough funds to cover the transaction. |

|

| R02 | Account Closed | A previously active account has been closed by an action of the customer or the RDFI. |

|

| R03 | No Account / Unable to Locate Account | The account number structure is valid, and it passes the check digit validation, but the account number does not correspond to the individual identified in the entry, or the account number designated is not an open account. |

|

| R04 | Invalid Account Number | The account number structure is not valid. The account number may have failed the check digit validation or has the wrong number of digits. |

|

| R05 | Unauthorized Debit Entry | The account number structure isn't valid. The account number may have failed the check digit validation or has the wrong number of digits. |

|

| R06 | Returned per ODFI’s Request | The ODFI (Originating Depository Financial Institution) has requested that the RDFI (Receiving Depository Financial Institution) return the ACH entry. If the RDFI agrees to return the entry, the ODFI must indemnify the RDFI according to Article Five (Return, Adjustment, Correction, and Acknowledgment of Entries and Entry Information) of the ACH Rules. |

|

| R07 | Authorization Revoked by Customer (adjustment entries) | Authorization Revoked by Customer – Consumer, who previously authorized ACH payment, has revoked authorization from the Originator (must be returned no later than 60 days from the settlement date, and the customer must sign an affidavit). |

|

| R08 | Payment Stopped or Stop Payment on Item | The Receiver of a recurring debit transaction has the right to stop payment on any specific ACH debit. The RDFI should verify the Receiver’s intent when a request to stop payment gets made to verify the request isn't intended to be a revocation of the authorization. |

|

| R09 | Uncollected Funds | A sufficient book or ledger balance exists to satisfy the dollar value of the transaction, but the dollar value of transactions in the process of collection (i.e., uncollected checks) brings the available and/or cash reserve balance below the dollar value of the debit entry. |

|

| R10 | Customer Advises Not Authorized; Item Is Ineligible, Notice Not Provided, Signatures Not Genuine, or Item Altered (adjustment entries) | For entries to Consumer Accounts that are not PPD debit entries constituting notice of presentment or PPD Accounts Receivable Truncated Check Debit Entries in accordance with Article Two, subsection 2.1.4(2), the RDFI has been notified by its customer, the Receiver, that the Originator of a given transaction has not been authorized to debit his account.[For entries to Consumer Accounts that are not PPD Accounts Receivable Truncated Check Debit Entries in accordance with Article Two, subsection 2.1.4(2) (Authorization/Notification for PPD Accounts Receivable Truncated Check Debit Entries), the RDFI has been notified by its customer, the Receiver, that the Originator of a given transaction has not been authorized to debit his account. |

|

| R11 | Customer Advises Entry Not in Accordance with the Terms of the Authorization | Used by the RDFI to return an entry for which the Originator and Receiver have a relationship, and an authorization to debit exists, but there is an error or defect in the payment such that the entry does not conform to the terms of the authorization. (i.e., “an incorrect amount,” “payment was debited earlier than authorized” ) For ARC, BOC, or POP errors with the original source document and errors may exist. (i.e., “document is ineligible”, “notice was not provided to Receiver”, “amount was not accurate per the source document”). |

|

| R12 | Branch Sold to Another DFI | A financial institution may continue to receive entries destined for an account at a branch that has been sold to another financial institution. Because the RDFI no longer maintains the account and is unable to post the entry, it should return the entry to the ODFI. |

|

| R13 | RDFI not qualified to participate | Financial institutions are not qualified to participate in ACH, or the routing number is incorrect. |

|

| R14 | Representative Payee Deceased or Unable to Continue in that Capacity | The representative payee is a person or institution authorized to accept entries on behalf of one or more other persons, such as legally incapacitated adults or minor children. The representative payee is either deceased or unable to continue in that capacity. The beneficiary is not deceased. |

|

| R15 | Beneficiary or Account Holder (Other Than a Representative Payee) Deceased | (1) The beneficiary is the person entitled to the benefits and is deceased. The beneficiary may or may not be the account holder; or(2) The account holder (acting in a non-representative payee capacity) is an owner of the account and is deceased. |

|

| R16 | Account Frozen | The funds in the account are unavailable due to specific action taken by the RDFI or by legal action. |

|

| R17 | File Record Edit Criteria (Specify) | Some fields that are not edited by the ACH Operator are edited by the RDFI. If the entry cannot be processed by the RDFI, the field(s) causing the processing error must be identified in the addenda record information field of the return. |

|

| R20 | Non-Transaction Account | The ACH entry is destined for a non-transaction account. This would include either an account against which transactions are prohibited or limited. |

|

| R23 | Credit Entry Refused by Receiver | The Receiver may return a credit entry because one of the following conditions exists: (1) a minimum amount required by the Receiver has not been remitted; (2) the exact amount required has not been remitted; (3) the account is subject to litigation and the Receiver will not accept the transaction; (4) acceptance of the transaction results in an overpayment; (5) the Originator is not known by the Receiver; or (6) the Receiver has not authorized this credit entry to this account. |

|

| R29 | Corporate Customer Advises Not Authorized | The RDFI has been notified by the Receiver (non-consumer) that the Originator of a given transaction has not been authorized to debit the Receiver’s account. |

|

A Notification of Change (NOC) is a notice sent from a customer’s bank detailing the information that changed in a transaction to allow it to be successful.

For example, if you paid out one of your merchants, and they accidentally put the wrong routing number or bank account number. Instead of the transaction failing, a NOC gets generated as the bank successfully delivers the payout to the merchant.

The NOC informs the Payment Facilitator of what occurred and provides the necessary information to rectify the issue. When a NOC of change happens, depending on the changes made, you may receive a Payment Instrument updated webhook event as Finix complies with NOC laws from NACHA.

| Code | Description | Next Steps |

|---|---|---|

| C01 | Incorrect account number | Update the Payment Instrument with the correct account number |

| C02 | Incorrect routing/transit number | Update the Payment Instrument with the correct routing number |

| C03 | Incorrect routing/transit number and incorrect account number | Update the Payment Instrument with the correct routing and account number |

| C04 | Incorrect account name | Update the Payment Instrument with the correct account name |