Learn how you get paid from the payments you've processed.

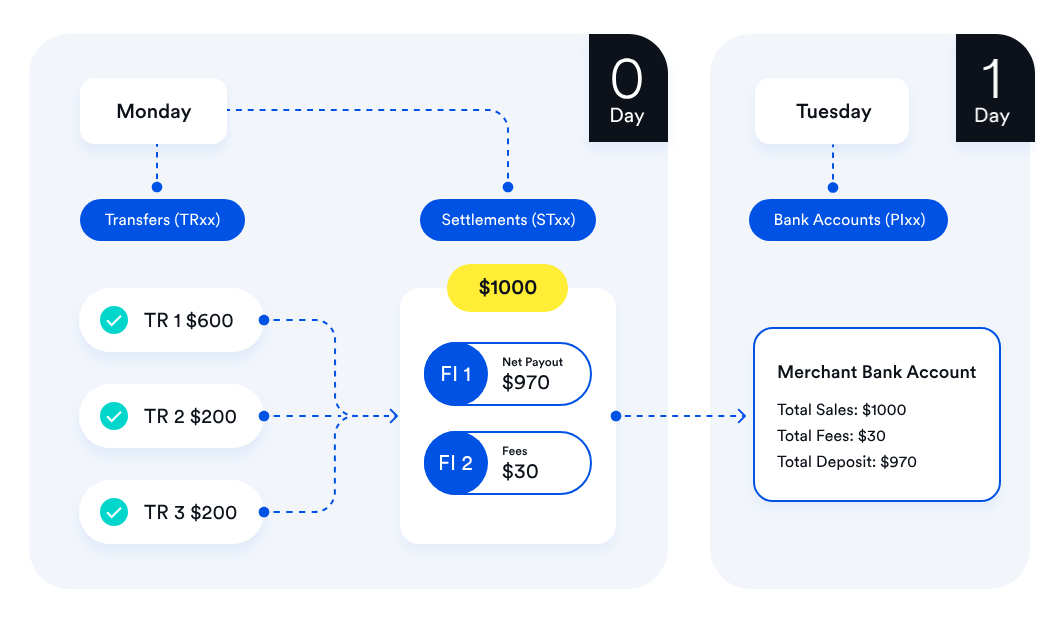

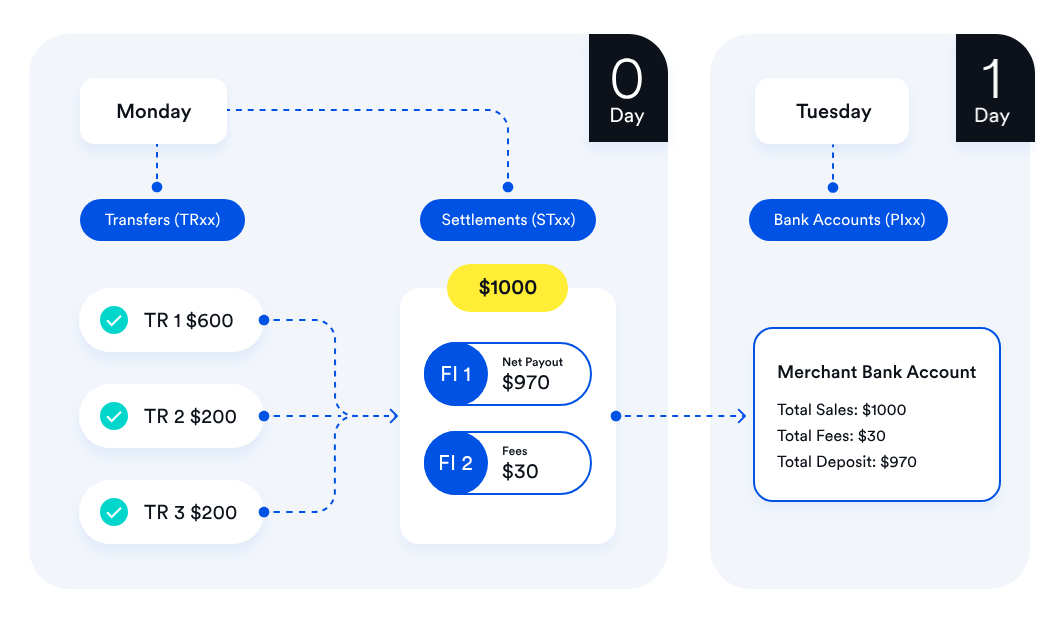

As you process payments, Finix buckets the funds from transactions into Settlements. After Finix reviews and approves your settlement, you will receive a Funding Transfer with your payout.

Finix processes payouts on a daily basis every business day. The timing of when funds from transactions are deposited into your merchant bank account depends on your payout configuration (T+1 or T+2) and the payment method used (card vs. ACH).

Payout timing is based on business days (Monday-Friday), excluding bank holidays.

Finix pays out to the bank account you provided in your Onboarding Form.

You can change your payout account later, but it will require review by our risk team.

Finix offers two payout availability options for card transactions:

Funds from card transactions are deposited into your bank account one business day after the transaction is processed.

Example:

A card transaction processed on Monday is batched Monday night. On Tuesday morning, Finix reviews and approves the settlement. The deposit is sent Tuesday early afternoon (EST) and typically appears in your bank account by Tuesday late afternoon.

Funds from card transactions are deposited into your bank account two business days after the transaction is processed.

Example:

A card transaction processed on Monday is batched Monday night. It is settled with the card networks on Tuesday (Day 1). Finix initiates an ACH transfer Tuesday evening. Funds are typically deposited into your bank account by Wednesday morning/afternoon (Day 2).

- In rare cases, some banks may have a delay in posting the deposit to your account.

- Canadian card transactions have additional delays in funding. Learn More

ACH Direct Debits take longer than card transactions to settle due to different network protocols and the risk of returns.

Finix holds ACH debits for a certain number of days to accommodate for any ACH returns (an ACH Settlement Delay). Finix's default delay is 5 business days for ACH Direct Debits.

Refer to ACH Direct Debit Timing for more information.

For information about faster payout options, see Bank Payouts.

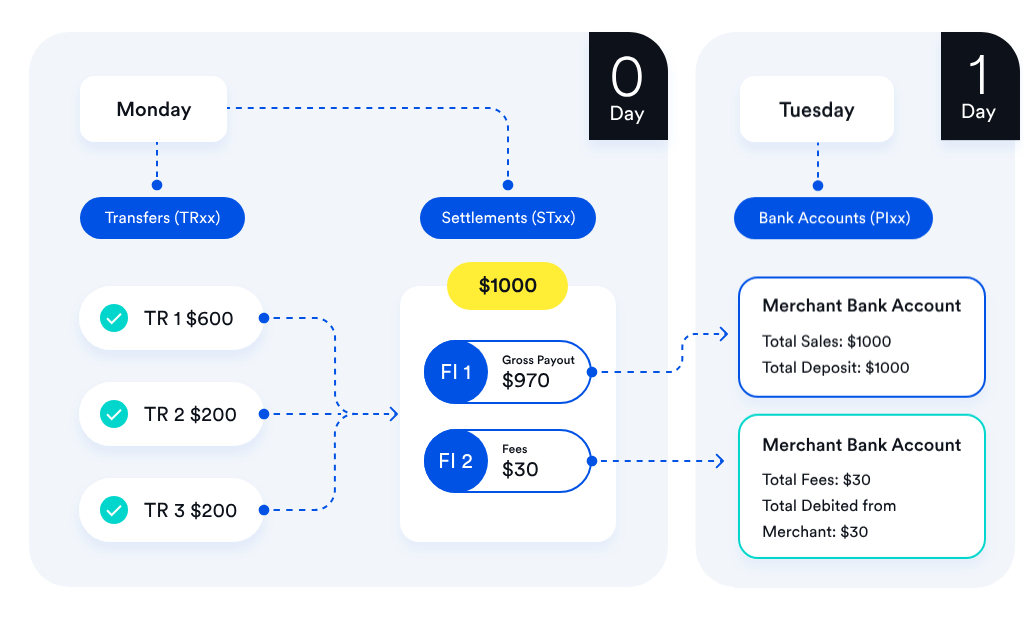

Finix offers two ways to configure payouts: Net and Gross. By default, payouts are calculated on a Net basis.

To change your payouts schedule or payout type (net / gross), contact the Finix Support team.

Fees get deducted from your payouts. In other words, deposits and fees are combined into one payout.

If you had $1000 in Payment and $30 in Fees, you'd receive a payout of $970 to your payout bank account.

Deposits and fees get distributed into two separate payouts.

If you had a $1000 Payment and $30 in Fees, you would receive two payouts. The first would be a $1000 credit to your payout account. The second would be a debit of $30 to your other account.

Using Finix, you can manage what accounts get used for your payouts. This includes which accounts you use for payouts and fees.

You can use the Finix Dashboard to find out:

- When you'll be paid out

- How much you will be paid

- Why you're receiving a specific amount

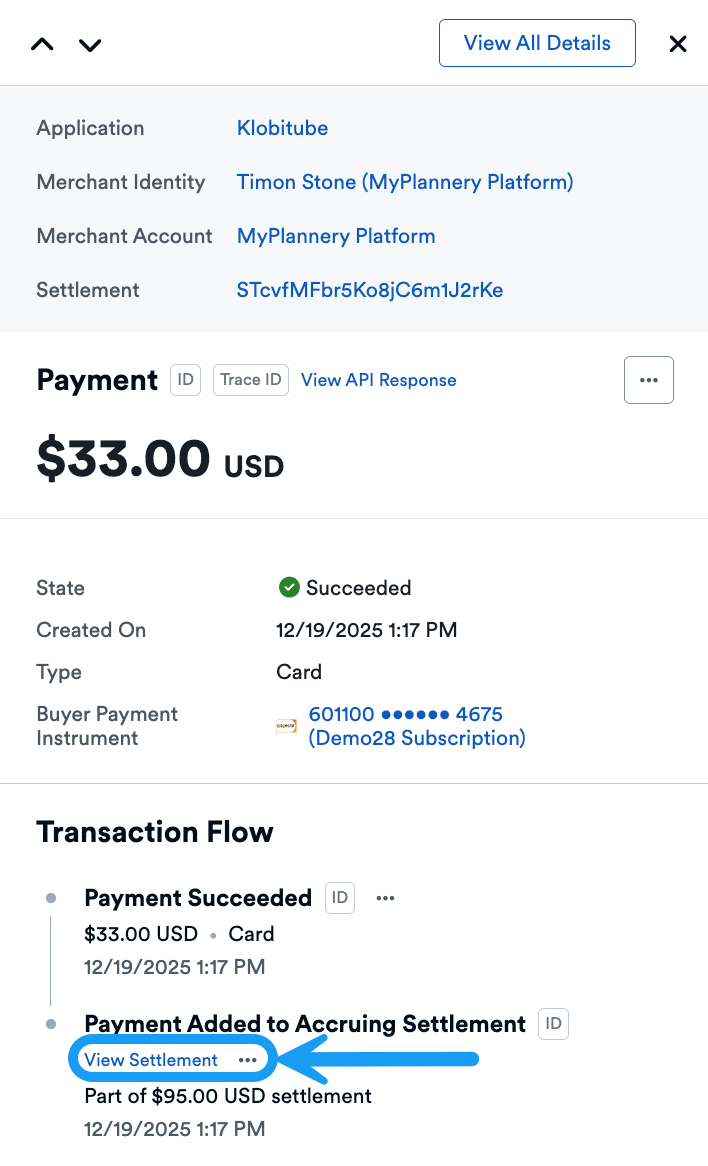

After a payment succeeds, it is added to an accruing settlement. In most cases, the settlement closes automatically, and you become eligible for payout when the accrual window ends. Some merchants are set up to release settlements manually, which requires a manual action to release the transaction.

Follow these steps to view settlement details for a successful payment that was added to a settlement:

Go to Transactions > Payments in the Finix Dashboard.

Find and click the payment you wish to view the settlement details for.

- A drawer opens from the right side showing a summary of the payment.

- Locate the "Transaction Flow" section in the drawer.

- Look for the entry labeled "Payment Added to Accruing Settlement".

- Next to this entry, you'll see a "View Settlement" link.

- Click the View Settlement link.

- The settlement details page displays with comprehensive information about the settlement.

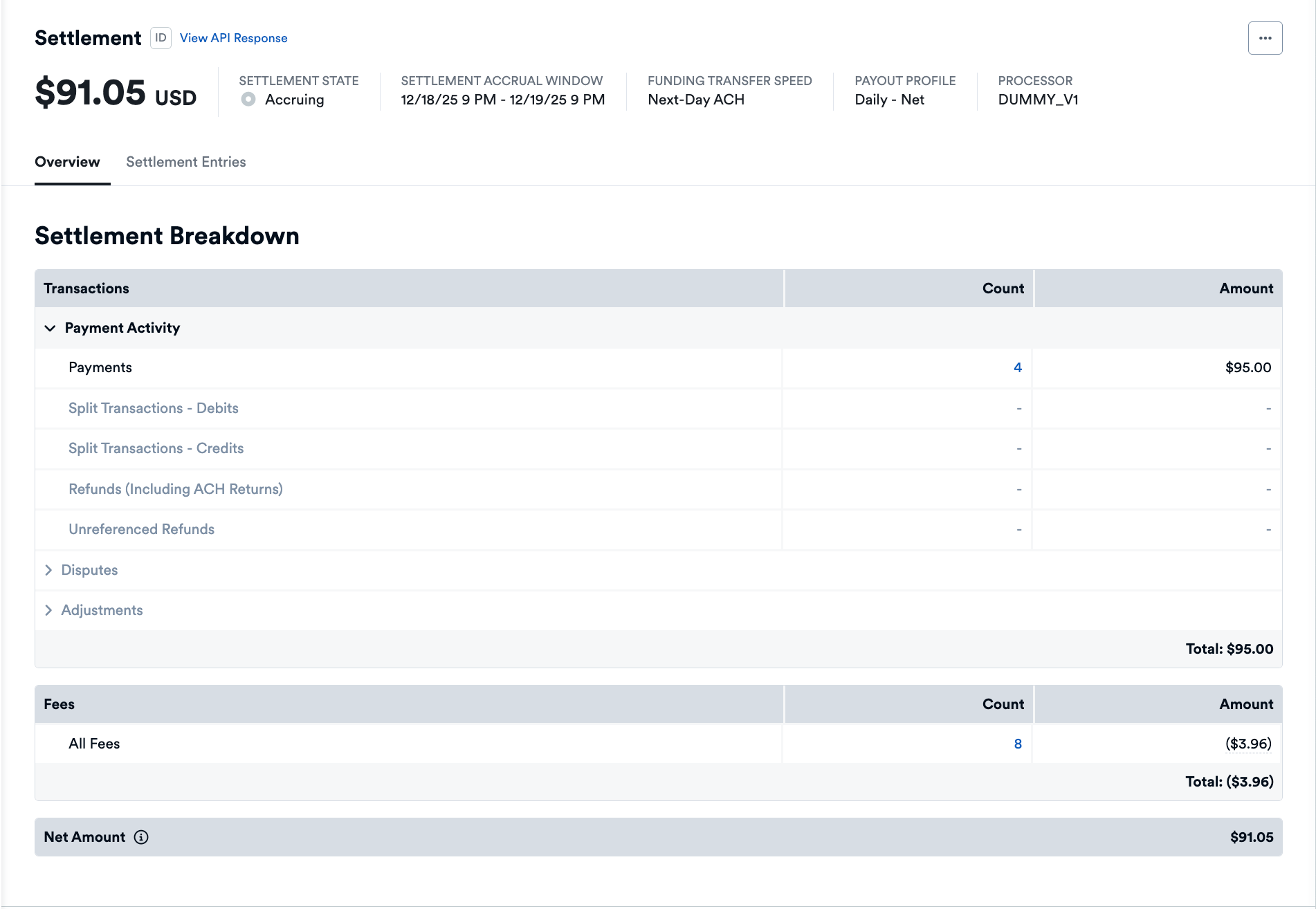

The settlement details page is organized into several sections that help you understand your payout.

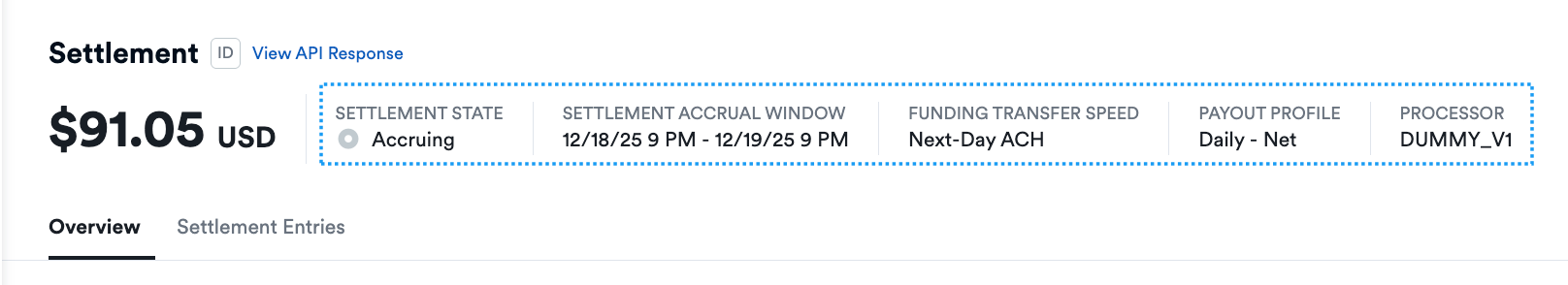

At the top of the Settlement Details page, you'll see key information about the settlement.

The following information is displayed:

Settlement State: The current status of the settlement.

- Accruing - The settlement is still open and collecting payments. More payments can be added to it.

- Awaiting Approval - The settlement has closed but hasn't been approved yet. You're not eligible for payout until it's approved.

- Approved - The settlement is closed and finalized. No more payments can be added. You're eligible for payout, and the payout has already been processed.

Settlement Accrual Window: (Visible only when settlement state is Accruing or Awaiting Approval) The timeframe during which the settlement collects payments.

- Example:

12/20/25 9 PM - 12/21/25 9 PM - Once this window closes at 9 PM, the settlement automatically moves to an approved state and you become eligible for payout.

- Example:

Funding Transfer Speed: (Visible only when settlement state is Accruing or Awaiting Approval) When you'll receive your payout after the accrual window closes.

- Next-Day ACH - Your payout will be transferred via ACH the next business day.

- Same-Day ACH - Your payout will be transferred via ACH on the same day.

Payout Profile: How frequently you receive payouts and how fees are handled.

- Example:

Daily - Net - Daily means you receive payouts every business day (as opposed to weekly or monthly).

- Net means fees are deducted from your payouts (deposits and fees are combined into one payout).

- Example:

Processor: The payment processing entity responsible for handling transactions and fund movements.

- Example:

DUMMY_V1

- Example:

Below the information header, you'll see the Settlement Breakdown section.

This section shows the following:

Payments: The total amount from all individual transactions included in this settlement.

Fees: Associated charges deducted from your payout.

Net Amount (Total Payout Amount): The final amount you'll receive after fees are deducted.

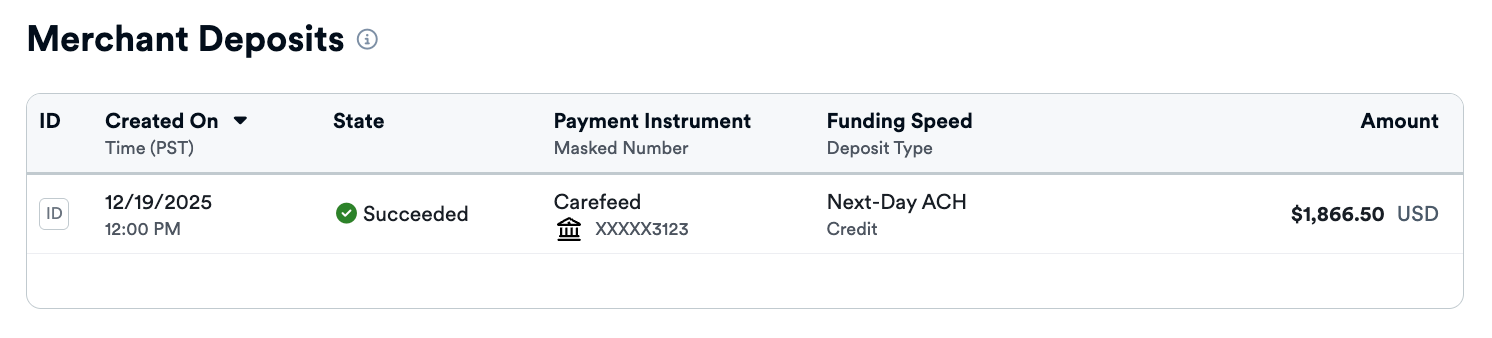

(Visible only when settlement state is Approved) This section shows the status of funds transferred to your connected bank account.

The following states are possible:

- Succeeded - The payout was successfully deposited into your bank account.

- Failed - The deposit did not go through, often due to incorrect bank information or a block by your bank. You may need to update your bank information or contact your bank.

Payouts may be delayed for several reasons:

As a risk mitigation measure, Finix has the right to temporarily withhold the first payout while conducting a standard risk review. This review is a required step in our risk mitigation process and helps us verify the legitimacy of payments activity. During this time, Finix may request supporting documentation (such as invoices or service agreements) to validate transactions.

In addition to the first large payout, Finix may also delay or hold subsequent payouts if we detect unusual activity. This may include significant increases in settlement volume, high dispute rates, or elevated ACH return rates. These reviews are essential for fraud prevention and compliance with regulatory obligations.

Bank processing can be delayed by weekends and holidays. Once the bank has finished processing your payout, the funds will be deposited into your account automatically.

If a payout is scheduled to be sent on a weekend or bank holiday, it will be processed on the next business day. For example, a payout scheduled for Saturday will be initiated on Monday morning.

In some cases, you can have a negative balance.

For example, if you receive $200 but then process a refund for $300, your settlement amount would be -$100.

If you don't process transactions to balance out the negative amount, Finix will eventually create a Funding Transfer that debits your payout bank account.