Finix allows you to monetize your payments by charging Fees to your sellers.

Fees are the revenue you make for processing transactions. You can also charge Fees for specific events like disputes and ACH returns.

Finix offers a number of ways to charge Fees to your sellers.

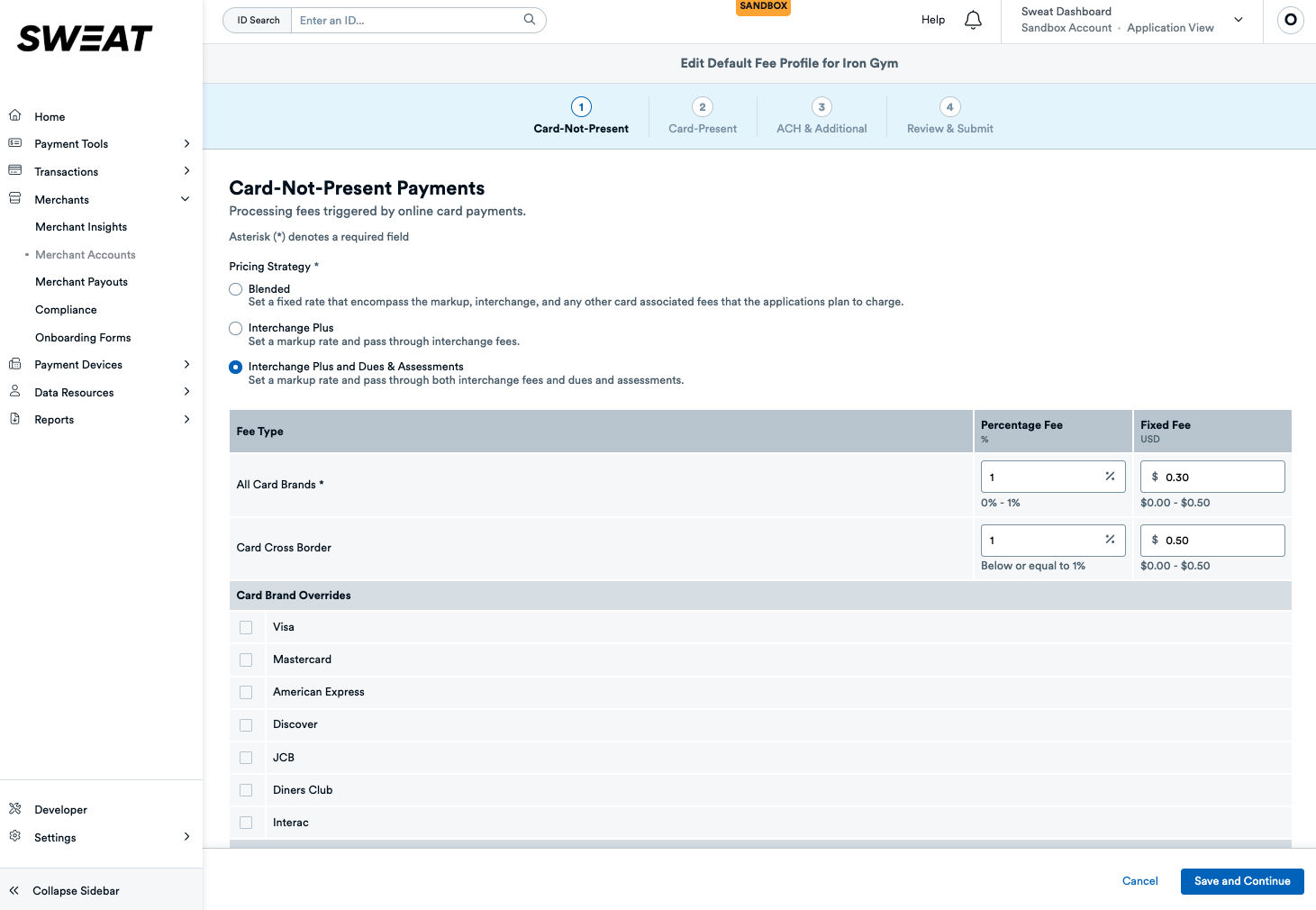

Finix's Merchant Fee Profiles take care of the heavy lifting and supports many different pricing strategies and fees.

Your sellers pay the interchange rate set by the issuing banks plus a markup you can charge on top.

Your sellers pay the interchange rate as well as separate pass-through of card network fees (dues and assessments). Finix provides many of these Dues and Assessments at a Transaction level.

Transactions are charged a single flat rate (e.g. 2.90%+ 30 cents). There are additional features to charge different card brands (e.g. Visa, MasterCard, Discover, and Amex) and payment methods a different rate.

Finix has 60+ fee options to monetize your payments. To see all available fees, see our Fee Profile guide.

Some platforms have dynamic pricing strategies that depend on a number of factors such as promotions, concessions, and other criteria.

In this case, Finix makes it easy to be able to support these use cases. You can use our /transfers API to pass in a supplemental_fee that can be varied on each transaction.

For additional information, see our Dynamically Calculating Fees Guide.

Some platforms choose to take a small portion of every payment. Finix supports this using our Split Transactions functionality. To learn more about Split Transactions, see our guide here.