This guide outlines the fees eligible merchants are able to charge their customers to offset the cost of payment processing when using certain card brands.

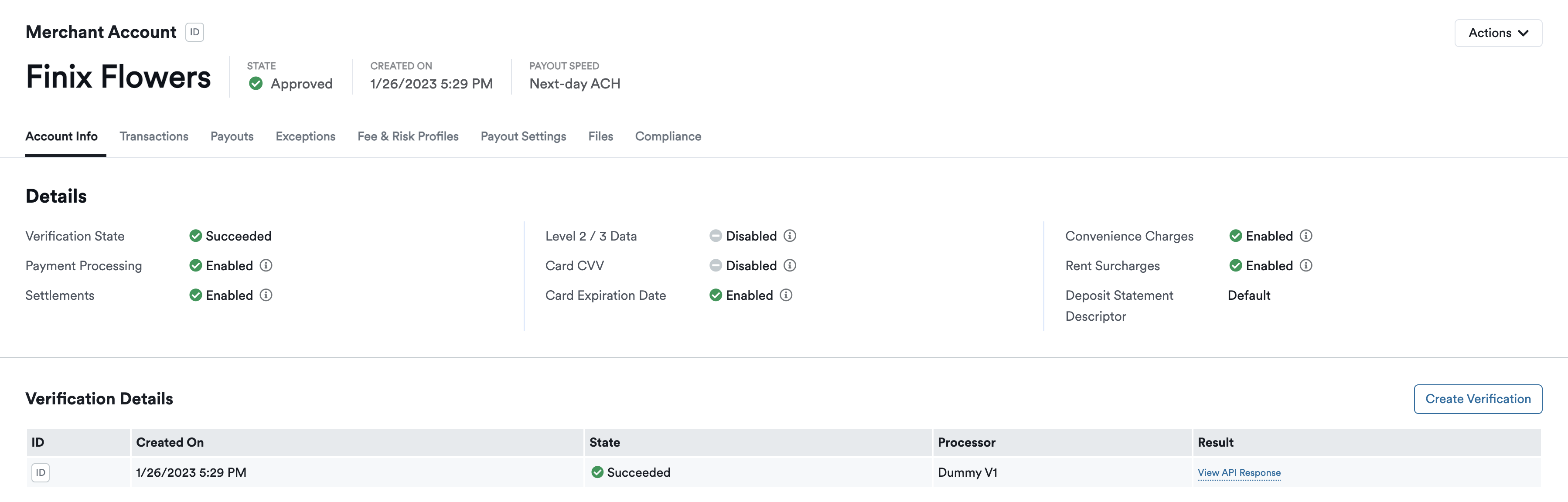

Use the Finix Dashboard to verify buyer charges are enabled for sellers:

The buyer charges available to sellers include:

- Common Fees: Any additional charges passed to the buyer that is not used to offset the cost of processing payments. (e.g. delivery fees, fuel costs, priority fees, handling fees, utensil fees, etc.)

- Card Brand Fees: Charges used to offset the cost of processing payments. Card Brand Fees are regulated and monitored by card networks. (e.g. Visa Rent Fees, Convenience Fees, Service Fees)

For most situations, we recommend using common fees.

Here are a few examples of the different fees you can charge buyers using Common Fees. Please note that this is only a selection of the different names sellers can call common fees:

| Name | Description |

|---|---|

| Administrative Fee | A fee charged to buyers to cover costs related to administrative services as part of a service or good. |

| Bottle Deposit and Bag Fees | A fee charged to the buyer for containers and packaging. |

| Cleaning Fee | A fee charged to the buyer for costs related to cleaning property. |

| Delivery Fee | A fee charged to buyers to cover costs related to delivery. |

| Fuel Surcharge | A fee used to cover costs related to fuel which can fluctuate greatly. This can be in addition to any other fee, including delivery. |

| Marketplace Fee | A fee charged to marketplace users to cover costs related to the regulatory, safety and operational requirements the marketplace must follow. |

| Priority Fees | A fee charged to the buyer for faster delivery or service. |

| Processing Fee | A fee charged to buyers to cover costs associated with processing an order. |

| Regulatory Fee | A fee charged to buyers to cover costs associated with government regulation. |

| Shipping Fee | A fee charged to buyers to cover costs associated with shipping or mailing out goods. |

Here are the different Card Brand Fees sellers can charge buyers using Buyer Charges. Card-Related Fees are regulated by card networks and include:

| Name | Description |

|---|---|

| Card Surcharge Fees | A fee to charge buyers to offset the cost of processing that the seller would normally incur. |

| Card Convenience Fees | A fee to charge buyers for providing a more convenient payment channel. |

| Card Service Fees | A fee to charge buyers that only certain MCCs are eligible to charge (specifically in the education or government industry). |

| Visa Rent Fees | A fee to charge renters for making payments to qualified landlords under the Visa Rent Program. |

Please consult your legal counsel if you have questions about a seller's eligibility to use Buyer Charges. Eligibility is determined by card brands and their operating rules.

Verifying the seller complies with the fee and surcharge rules listed in Visa Core Rules and Visa Product and Service Rules (section 5.5.1.8 - Credit Card Surcharge Requirements) is an excellent guideline to confirm if the seller can use buyer charge.

See the following for a comparison and questions to help you determine if Buyer Charges are appropriate for your seller's use case.

Comparison of Buyer Charges

| Name | Environment | Fee Structure | Fee Amount | Card Types | Additional Registration Required | Other Limits |

|---|---|---|---|---|---|---|

| Common Fees | Online or In-Person | Flat or Percent | Similar to the purpose of the fee | Credit or Debit | No | Can't be related to processing payments. |

| Surcharge Fees | Online or In-Person | Flat or Percent | Max 4% of transaction | Credit | Yes | Not allowed in all 50 states (consult your legal counsel). |

| Convenience Fees | Online | Flat | Suggested 3% of avg. transaction | Credit or Debit | No | Seller's primary payment channel must be In-Person. |

| Service Fees | Online | Flat or Percent | Suggested 3% of avg. transaction | Credit or Debit | No | Only education and government MMCs. |

| Visa Rent Fees | Online | Flat or Percent | Max $10 for Debit or 4% for Credit | Credit or Debit | Yes | Only real estate MCCs. |

Buyer Charges Questionnaire

| Yes | Common Fees | Examples include delivery fees, fuel fees, administrative fees, fuel charges, servicing fees, priority fees, taxes, etc. This fee can't be tied to a cost related to accepting card payments. |

| No | Next Question | N/A |

| Yes | Card Service Fees | See the following list for eligible MCCs. |

| No | Next Question | N/A |

Eligible Education and Government MCCs include:

| MCC | Description |

|---|---|

| 8211 | Elementary and Secondary Schools |

| 8220 | Colleges, Universities, Professional Schools, and Junior Colleges |

| 8244 | Business and Secretarial Schools |

| 8249 | Vocational and Trade Schools |

| 9211 | Court Costs, Including Alimony and Child Support |

| 9222 | Fines |

| 9311 | Tax Payments |

| 9399 | Government Services (Not Elsewhere Classified) |

| Yes | Card Visa Rent Fees | This fee enables sellers to collect fees from buyers on both Debit and Credit cards for rent payments. |

| No | Next Question | N/A |

| Yes | Convenience Fees | Qualified sellers can collect fees on Online payments if it's an alternative to how they primarily accept payments. The fee must be a flat fixed amount. |

| No | Surcharge Fees | This fee allows you to collect fees on exclusively credit cards in any environment. The fee can either be a fixed flat fee or fixed percent fee. |

Once enabled, Merchants can include a buyer charge with the Transfers or Authorizations they create to process transactions and move funds.

To include a buyer charge with a transaction, when creating a Transfer or Authorization, include the additional_buyer_charges object to detail what portion of the amount should get paid out as a buyer charge.

The value passed for a buyer charge will not impact the amount charged to a cardholder. Instead, only amount determines how much the buyer gets charged.

Transactions with buyer charges pay out funds the same way as other transactions in Finix.

- Transactions with Buyer Charges can be identified by the

Transfer#additional_buyer_charges(orAuthorizations#additional_buyer_charges) fields. - The seller gets paid out

Transfer#amount(orAuthorization#amount) minus any fees that were applied to that transaction or configured in the seller'sFee Profile.

Finix Core customers can use a PUT request to enable buyer charges for a Merchant. For Finix Flex customers reach out to Finix Support and request the seller's Merchant account be enabled to use Buyer Charges.

If Buyer Charges are enabled, as the platform, it is your responsibility to ensure every enabled Merchant account complies with card brand rules and applicable legal requirements. Rules and requirements can be found in Visa Core Rules and Visa Product and Service Rules.

- Sandbox serverhttps://finix.sandbox-payments-api.com/merchants/{merchant_id}

- Production serverhttps://finix.live-payments-api.com/merchants/{merchant_id}

curl -i -X PUT \

-u USfdccsr1Z5iVbXDyYt7hjZZ:313636f3-fac2-45a7-bff7-a334b93e7bda \

https://finix.sandbox-payments-api.com/merchants/MUwfZPNW3r4EqLMzwgr6txw4 \

-H 'Content-Type: application/json' \

-d '{

"convenience_charges_enabled": true

}'Set to true if you want to enable the Merchant to accept convenience fees and/or service fees.

Set to true if you want to enable a Merchant to accept rent charges.

Set to true if you want to enable a Merchant to accept surcharge fees.

Include up to 50 key: value pairs to annotate requests with custom metadata.

- Maximum character length for individual

keysis 40. - Maximum character length for individual

valuesis 500. (For example,order_number: 25,item_type: produce,department: sales)

The APIs to update Merchant flags are only available for Finix Core customers. If you have additional questions, please reach out to your Finix point of contact or Finix Support.

For accounting purposes, if you plan on categorizing Buyer Charges as fees, we recommend making these changes to the Payout Settings and fee_profile of Merchants:

- Set the Payout Type in Payout Settings to Net. For more details, see Managing Your Sellers and Payouts.

- Set the

fixed_feeon thefee_profileto0. For more details, see Collecting Seller Fees and Fee Profiles.- In the dashboard, update Per Item next to All Card Brands.

- Set

basis_pointson thefee_profileto the Buyer Charge you'll pass on to buyers.

Use the following equation to calculate basis_points. Be sure the entered value is converted into basis points (BPS = Buyer Charge Percentage X 100):

Once calculated, update basis_points in fee_profiles with the new figure (converted to basis points). Alternatively, in the dashboard, update Per Item next to All Card Brands.